Table of Content

Only in some cases you will need to go to the nearest branch of your Bank. State Bank of India, HDFC Bank, Axis Bank, does loan process for fixed deposit online. Whereas, in Federal Bank, no online services get provided. V. Partnership companies, group associations, or other big businesses can take loan against fixed deposits.

The interest rate against the fixed deposit is 0.75% more than the interest rate being paid for actual FD. A loan would get marked on your fixed deposit to prevent its withdrawal till the loan is repaid. If any third party customers avail of the loan, you’ll have a 4% interest rate. For loans above one crore, you’ll need to pay an interest rate of 3%. You won’t get charged for any extra bucks when seeking the preclusion of the credit from your fixed deposit. Now feed the savings account number that is to be debited.

FAQs on SBI Home Loan

By taking loans from your own fixed money, you don’t have to go for some other loan processes. You will get an interest rate along with it on your fixed money. The bank offers several fixed deposit plans to cater the diverse financial needs of the customers. It provides deposits for tenures ranging from 7 days to 10 years at varied interest rates. You can open a fixed deposit account with the lowest amount of INR 1,000.

Personal loan and other loans consist of a higher interest rate than loans against FD . We'll ensure you're the very first to know the moment rates change. 10% TDS will be applicable if the earned interest is more than Rs. 40,000 in a financial year. The calculation is done considering all the FDs you may have with the bank.

Reader Interactions

After maturity, the amount will be transferred to your bank account, unless the deposit is renewed. For FDs maturing between two years to less than three years, the interest rate has been raised to 6.75 percent from 6.25 percent. On deposits maturing between three years to less than five years, the interest rate has been increased to 6.25 from 6.10 percent. For FDs maturing between five years to up to 10 years, the interest rate has jumped to 6.25 percent from 6.10 percent.

The minimum period of fixed deposit is at least seven days, and the maximum period is ten years. Currency of fixed deposit is Singapore dollars by default. The same goes for a savings account, i.e., Singapore dollars by default. All the interest achieved from the fixed deposit is fully taxable. Instead of deducting tax on the fixed deposit’s maturity, it gets deducted during the time they credit interest to your account. Banks deduct TDS at the end of each of your fixed deposit time.

Age limits For Home Loans In Fixed Deposits

Yes, if you want to invest for a short period like three months, you can open a fixed deposit. For a small-time fixed deposit, a decent interest return is given. AU bank gives 6.90 percent for regular persons and 7.40 percent for the senior citizen if you invest for three months. The amount will get transferred to your mentioned savings account. To avoid misuse and fraud, you will have to withdraw a fixed deposit from your home branch only.

The question assumes significance given there are many banks and non-banking finance companies waiting to make you a customer. But the largest public sector bank State Bank of India has a distinctive advantage over others. The reason being the attractive interest rates as well as the massive PAN India presence with around 25,000 branches across the country. It won’t be wrong to say that SBI fixed deposit is a symbol of trust. The increased interest rates would apply to fixed deposits of up to Rs 2 crore. The higher interest rates on FDs are effective from December 13, 2022.

Mutual Fund

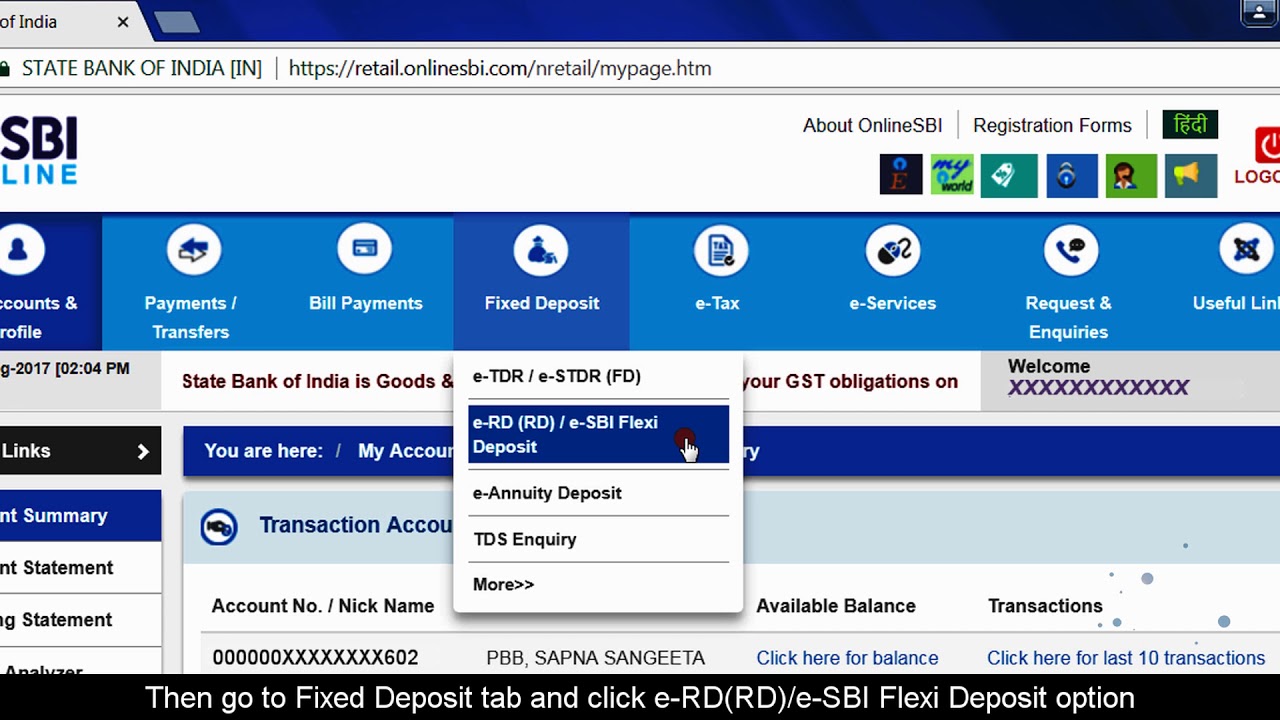

The interest rate of HDFC bank is subject to change. If all the joint members do not sign the application, the Bank will cancel the loan application. On clicking, the page will open where the depositor can create various deposits online. Park your lump sum amount in an SBI Term Deposit and avail of features like guaranteed returns, choice of interest pay-out, liquidity through OD or premature withdrawal. If you do not provide PAN information to the bank, then a TDS of 20% is applicable.

Interestingly, the 5-year tax saver fixed deposit of SBI doesn’t come with the maximum limit on deposits. You have the option to select the investment period and the amount of investment as per your financial goals. Depositors can receive interest at the payout frequency decided by them. State Bank of India is one of the leading public sector banks in India. It offers attractive interest rates on Fixed Deposit up to 6.20%. Senior citizens can earn an additional benefit of 0.5% on SBI FD interest rates.

During any emergency or urgent situation, you need to search for different schemes for loans. One of the processes you can go with is getting loan against your FD account. It will also save you time if you take short term loans.

The HDFC Bank also hiked the interest rates on FD for senior citizens effective from 14 December 2022. If you don’t have an FD account, it’s better to go with a personal loan. Alternative financing is much smaller than bank loans and has a high-interest rate. Alternative financing is used to start a new business, shortfalls in cash, financing small scales, etc.

In this, a lump sum amount gets invested, and payment gets rendered through equated monthly installments. Rupees minimum investment get allowed under this scheme. Yes SBI, HDFC Bank, and ICICI Bank are safe for fixed deposits as per RBI. For better and strong Banks emerge, more banks will soon be added to this list by RBI.

For senior citizens, the new rate will be 5.25 per cent as against 4.50 per cent. The Reserve Bank of India had last week hiked the repo rate by 0.50 per cent to 4.90 per cent. Repo is the short term lending rate RBI charges to the banks.

No comments:

Post a Comment